Why Exfiltration Prevention is Now a Compliance Imperative for Accounting Firms

As an accounting firm, safeguarding sensitive client data isn’t just best practice — it’s a regulatory imperative. From financial statements and tax returns to payroll and audit reports, the data you manage is a prime target for cybercriminals. And today’s attackers aren’t just encrypting it. They’re stealing it.

Data exfiltration, often paired with ransomware in double extortion schemes, has become the most damaging threat to firms like yours, where confidentiality, client trust, and regulatory compliance are non-negotiable.

Why Accounting Firms Are High-Value Targets for Data Theft

Accounting firms are increasingly vulnerable to exfiltration attacks for several reasons:

- Sensitive Financial Data — Firms handle high-value information such as tax filings, audit reports, payroll data, and financial forecasts — making them ideal targets for identity theft, fraud, and extortion.

- Strict Regulatory Obligations — Firms must comply with a range of data protection regulations including:

- GLBA (U.S.): Requires financial institutions (including tax preparers) to implement safeguards and incident response plans.

- SOC 2: Demands strict controls for security, confidentiality, and privacy.

- GDPR & PIPEDA: Mandate breach notification and proof of adequate data protection measures.

- State laws like CCPA/CPRA & NYDFS: Impose legal consequences for breaches involving exfiltrated data.

- Remote and Hybrid Work Vulnerabilities — With decentralized workforces and BYOD policies, endpoint protection gaps widen, especially during busy periods like tax season.

- Ransomware with Exfiltration (Double Extortion) — Attackers now steal data before encrypting it, increasing pressure to pay and multiplying compliance risks. Even if backups work, stolen data still poses a liability.

The Regulatory Consequences of Exfiltration

A data exfiltration event doesn’t just hurt your operations. It triggers a regulatory cascade:

- GLBA (U.S.): Requires breach response plans and customer notification. Noncompliance can result in penalties up to $100,000 per violation.

- GDPR (EU): Requires breach reporting within 72 hours. Fines can reach €20 million or 4% of annual revenue.

- PIPEDA (Canada): Mandates breach logs and notification if there’s a “real risk of significant harm.”

- CCPA/CPRA (California): Enables private right of action for data breaches—damaging both reputation and bottom line.

- SOC 2 (U.S.): A breach can derail certification efforts and trigger third-party audit failure.

In short: data exfiltration equals noncompliance.

Why Traditional Security Tools Fail at Exfiltration Prevention

Traditional security tools often fall short when it comes to preventing data exfiltration because they’re built to detect threats after they’ve already taken root. Sophisticated attackers frequently steal data early in the attack lifecycle—long before deploying ransomware or issuing demands. This early-stage exfiltration often goes unnoticed, leaving firms exposed and out of compliance before they even know an attack occurred.

Compounding the problem is the use of advanced, evasive techniques. Cybercriminals routinely leverage methods like DNS tunneling, Rclone, and encrypted cloud uploads to bypass traditional defenses. These tactics are specifically designed to evade endpoint detection and response (EDR) systems, allowing attackers to exfiltrate data quietly and efficiently.

Meanwhile, detection-based tools generate a high volume of alerts—most of which are noise. This alert fatigue overwhelms lean IT teams, delays response times, and increases the chances of a breach going undetected until it’s too late. For accounting firms that need to meet strict regulatory requirements and protect sensitive client data, real-time prevention is essential. Reactive detection simply isn’t enough.

How Morphisec Prevents Exfiltration and Ensures Compliance

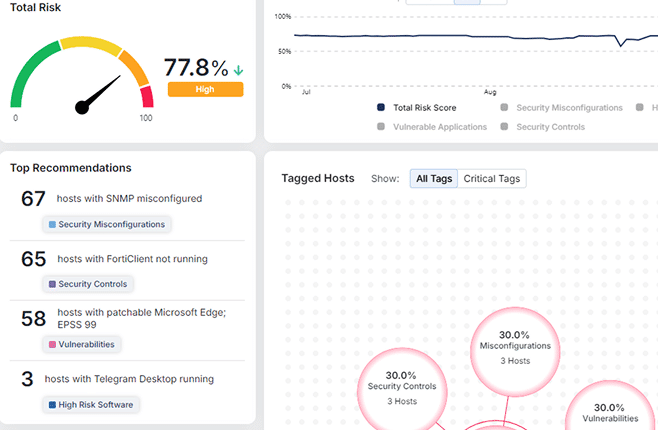

As part of its Anti-Ransomware Assurance Suite, Morphisec’s Automated Moving Target Defense (AMTD) and Adaptive Exposure Management (AEM) combine to deliver a prevention-first strategy that’s purpose-built for accounting firms navigating today’s regulatory and threat landscape. Here’s how:

Stops Data Theft Before It Happens

Morphisec prevents exfiltration attempts at the earliest stage — neutralizing scripts, processes, and tools before they run.

- Blocks Rclone, DNS tunneling, PowerShell scripts, and unauthorized uploads

- Eliminates dwell time — no attacker sits idle in your environment long enough to steal data

Exfiltration prevention satisfies regulatory demands for proactive data protection under GLBA, SOC 2, and GDPR.

Protects the Entire Attack Chain

Morphisec provides continuous protection:

- Pre-Execution: Reduces exposure through attack surface management

- During Execution: Blocks live attacks without signatures or prior knowledge

- Post-Execution: Enables clean, fast recovery from hidden backups if ransomware is attempted

From initial access to exfiltration and beyond, Morphisec stops attackers cold.

Reduces Legal and Compliance Risk

With deterministic controls and minimal false positives, Morphisec aligns with regulatory expectations for:

- Data security safeguards (GLBA, GDPR, PIPEDA)

- Secure audit trails (SOC 2)

- Risk-based exposure management (NYDFS, CCPA)

Works Seamlessly with Your Stack

Morphisec integrates with Microsoft Defender, SentinelOne, CrowdStrike, and others — adding a powerful prevention layer without disruption or downtime.

100% Ransomware-Free Guarantee

Morphisec backs its platform with a Ransomware-Free Guarantee — giving firms confidence that their client data and regulatory obligations are protected.

The Business Case for Accounting Firms

Protecting client trust is foundational to every accounting firm’s success. When clients share sensitive financial data, they expect confidentiality and discretion. Preventing data exfiltration ensures that trust is never compromised and reassures clients that their most valuable information is safe in your hands.

Strong cybersecurity isn’t just good practice—it’s essential for regulatory compliance. From GLBA to GDPR and PIPEDA, today’s data protection laws require firms to proactively safeguard sensitive information. By preventing breaches before they happen, your firm can avoid reportable incidents, fines, and the scrutiny that comes with noncompliance.

Operational continuity is also on the line. A successful ransomware or exfiltration attack can bring your firm to a halt, especially during peak times like tax season. With real-time prevention in place, your team can stay focused and productive—without worrying about unexpected downtime or ransom demands.

Finally, preventing data theft helps reduce legal exposure. A breach can open the door to lawsuits, insurance claims, and reputational damage that can take years to recover from. By stopping attackers before they access or steal client data, your firm stays out of court and in control.

Prevention = Protection and Compliance

In today’s threat landscape, accounting firms must move beyond legacy detection tools and adopt a prevention-first mindset. Morphisec helps you stop exfiltration before it starts, meet your regulatory obligations, and protect what matters most: your client data, your reputation, and your business continuity.

Book a demo to see how exfiltration protection from Morphisec can help protect your firm from ransomware and sophisticated attacks.

Stay up-to-date

Get the latest resources, news, and threat research delivered to your inbox.