The Regulatory Pressure Cooker: Why Financial Institutions Are Being Pushed Toward Preemptive Cyber Models

Financial institutions are operating under intensifying scrutiny. Once, cybersecurity regulations were largely about checklists and policies. Today, regulators are signaling that reactive security models are no longer enough.

With ransomware, supply chain compromises, and AI-enabled attacks targeting financial systems, regulators in America like the New York Department of Financial Services (NYDFS), the Securities and Exchange Commission (SEC), and federal banking agencies are tightening the rules.

The message is clear: compliance is no longer just about responding after the fact. Institutions must move toward preemptive, proactive cyber models that anticipate and neutralize threats before they cause damage.

NYDFS: Raising the Bar for Proactive Controls

The NYDFS has long set the tone for cybersecurity in the financial sector. Its landmark Cybersecurity Regulation (23 NYCRR Part 500), first introduced in 2017, was updated in November 2023 with a slate of new requirements phasing in through 2025.

Among the most impactful changes:

- Annual certifications: Starting April 15, 2025, regulated entities must certify material compliance (or disclose non-compliance and remediation plans).

- Technical controls: Mandatory vulnerability scanning, tighter restrictions on privileged accounts, and multi-factor authentication for remote access.

- Governance: Enhanced CISO accountability, with annual reporting to boards of directors.

- Third-party risk: Institutions must enforce cybersecurity standards across service providers and vendors.

- AI guidance: NYDFS has also issued guidance on how AI-driven risks (deepfakes, impersonation, new social engineering vectors) should factor into risk assessments.

These updates highlight a shift from policy to practice — requiring institutions to adopt continuous monitoring, proactive risk assessments, and future-ready security programs.

Beyond NYDFS, a web of federal agencies and councils are also pushing financial institutions toward more proactive practices:

- Banking agencies (OCC, FDIC, Federal Reserve): Require notification of material incidents within 36 hours and are increasing scrutiny of third-party providers.

- FFIEC: Continues to publish guidance around authentication, vendor management, and cloud risks.

- FTC Safeguards Rule (under GLBA): Reinforces the need to secure nonpublic customer financial data.

Together, these mandates are creating a patchwork of requirements that converge on a single expectation: anticipate threats, prove resilience, and demonstrate control over both internal systems and external partners. While the details differ across agencies, the regulatory direction is unmistakable:

- Governance matters: CISOs and boards are directly accountable.

- Continuous monitoring is required: Vulnerability scanning, privileged access controls, and audit trails are becoming mandatory.

- Rapid response is non-negotiable: Timelines of 36 hours to 4 business days mean institutions must be incident-ready.

- Third-party oversight is critical: Vendor ecosystems can no longer be a blind spot.

In short: regulators expect financial institutions to act before attackers succeed, not after.

Challenges for Financial Institution

Meeting these expanding regulatory expectations is far from straightforward.

One of the biggest hurdles lies in defining materiality under pressure. When regulators like the SEC demand disclosure of “material” cyber incidents within four business days, organizations must have both the technical insight and governance processes to make that determination quickly and defensibly.

At the same time, financial institutions are grappling with a patchwork of overlapping and sometimes conflicting requirements across state, federal, and industry regulators, forcing security leaders to constantly balance priorities and compliance timelines.

Compounding these pressures are talent and resource shortages. As attacks grow in sophistication, cyber teams are stretched thin, leaving many organizations with gaps in monitoring, risk assessment, and vendor oversight.

The challenge doesn’t end at the enterprise boundary. Many financial firms rely on sprawling third-party ecosystems where enforcing consistent security standards is difficult, yet regulators now expect full accountability for vendor risk. All of this means financial institutions must find ways to elevate their cyber posture without adding unsustainable operational complexity.

Why a Preemptive Cyber Model Is the Answer

To meet these demands, financial institutions need to shift from a reactive stance to a preemptive one.

Preemptive cyber defense is a must-have security strategy for security leaders. It’s an emerging approach that prioritizes stopping threats before they materialize. Instead of waiting for indicators of compromise to surface, preemptive technology stops adversaries before they can escalate, reducing the likelihood that a breach ever reaches the point of requiring disclosure.

By preventing incidents at the outset, financial institutions not only avoid regulatory headaches but also ensure they can meet compressed reporting timelines with confidence. Having fewer material incidents to report makes governance more straightforward, while strong playbooks and incident readiness frameworks provide the structure needed when disclosures are required.

Most importantly, a preemptive model demonstrates to regulators, boards, and investors that the institution is not just compliant on paper, but resilient in practice, transforming cybersecurity from a compliance burden into a source of trust and operational strength.

How Morphisec Helps Financial Institutions Meet and Exceed Regulatory Expectations

Morphisec’s prevention-first approach is purpose-built for this new regulatory era. Powered by its Automated Moving Target Defense (AMTD) deception technology, and complementary preemptive controls, Morphisec’s Anti-Ransomware Assurance Suite stops attacks before they can take hold, even advanced ransomware, zero-days, or fileless malware.

Here’s how Morphisec aligns with regulatory demands:

- Preemptive defense: Neutralizes threats before they can cause damage, reducing reliance on post-breach detection.

- Legacy protection: Secures older systems that remain part of many financial environments, closing gaps regulators increasingly scrutinize.

- Faster containment: Blocks attacks early, helping institutions avoid incidents that would trigger 36-hour or 4-day reporting requirements.

- Audit-ready controls: Fills gaps often highlighted in NYDFS and FFIEC examinations, such as privileged escalation or ransomware resilience.

- Low-overhead operations: Lightweight deployment integrates seamlessly with existing security stacks, a critical factor for resource-constrained teams.

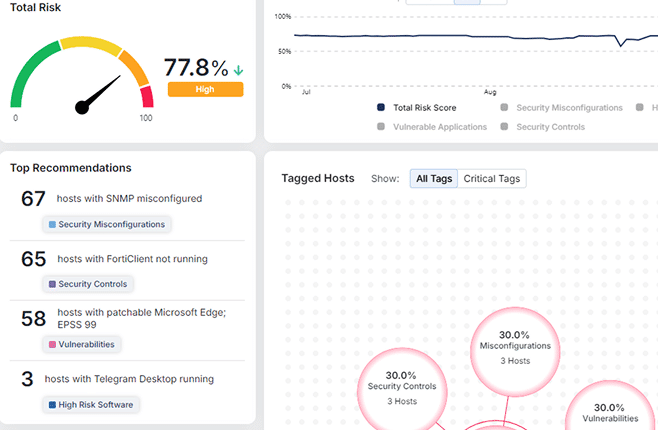

- Adaptive exposure management: Provides visibility into software vulnerabilities, misconfigurations, and shadow IT, enabling ongoing risk assessment and governance.

With Morphisec, financial institutions can not only meet the letter of regulatory requirements but also embody the spirit of preemptive defense that regulators are demanding.

Compliance Is the Floor, Preemptive Defense Is the Ceiling

The regulatory environment is moving financial institutions away from reactive postures and toward proactive cyber resilience. NYDFS, FFIEC, and other agencies are mandating governance, rapid disclosure, and continuous monitoring, all of which point toward the need for a security strategy that’s led by preemptive cyber defense.

Compliance may keep institutions off the regulators’ radar, but true resilience comes from going further.

By adopting preemptive technologies like Morphisec’s AMTD and adaptive exposure management, financial institutions can transform regulatory pressure into a competitive advantage — protecting customers, investors, and trust in the process.

Read how Merrick Bank closed security gaps and improved their audit scores with Morphisec.

Stay up-to-date

Get the latest resources, news, and threat research delivered to your inbox.