Evolve or Be Exposed: Why Financial Institutions Must Shift to Preemptive Cyber Defense

In today’s financial services landscape, the cybersecurity stakes have never been higher.

As organizations juggle digital transformation, regulatory complexity and evolving threats, one thing is clear: the old reactive model of “detect-and-respond” is no longer sufficient.

For companies in banking, payments, credit-issuance and asset-management, the threat horizon is evolving at breakneck speed:

- The recent report “Ransomware Attacks in Finance Hit New High” indicates that 49% of financial-services organizations hit by ransomware said their data was successfully encrypted; the highest-ever rate for the sector.

- In that same study, 46% of finance firms managed to stop an attack before data lock-up, a sign that while defense is improving, attackers are getting closer to the crown-jewels.

- Globally, ransomware attacks rose 34% in the first three quarters of 2025 compared to the same period in 2024.

- According to the “State of Ransomware 2025” research by Sophos: exploited vulnerabilities remain the #1 root-cause, and 63% of organizations fell victim due to lack of people or skills.

For financial institutions, where customer trust, regulatory oversight and transaction integrity are daily imperatives, this means the margin for error is vanishingly small.

Why compliance alone isn’t enough

Regulations like the PCI DSS (Payment Card Industry Data Security Standard), along with sector-specific guidance on cyber resilience, demand that organizations demonstrate ‘effective controls’ over threats such as ransomware.

But meeting the checkbox doesn’t automatically mean you’re resilient. Being compliant is a baseline; being preemptively secure is a competitive differentiator.

When threats shift to fileless attacks, in-memory exploits and zero-day techniques that bypass traditional signature-based tools, you may still “pass” compliance audits yet remain exposed in practice.

The difference between simply complying and genuinely defending is where leading institutions differentiate themselves.

From reactive to preemptive: a mindset shift

Here’s what a preemptive cyber defense mindset looks like:

- Assume breach rather than “hope we get lucky”. Attackers can strike bypassing detection; the question becomes when, not if.

- Pre-execution neutralization of attacks—stop them before they execute, rather than cleaning up afterwards.

- Protection everywhere: endpoints, legacy servers, virtual desktops (VDI), especially in hybrid/cloud environments.

- Minimal operational disruption: Protection must not degrade performance, especially in environments where downtime = lost transactions + customer frustration.

- Audit-friendly, not audit-burdensome: Controls that deliver real prevention AND simplify regulatory/ audit reporting.

How one bank made the leap

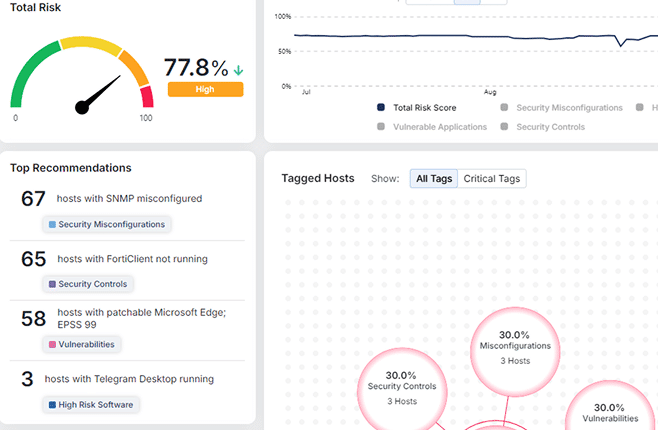

Consider the case of Merrick Bank, a U.S. credit-card issuer and consumer lender with ~$5.3 billion in assets. The bank faced several security and compliance headwinds: legacy servers that couldn’t support modern agents, fileless and in-memory threats bypassing traditional tools, and operational risk linked to agent-based technologies causing I/O slowdowns.

To evolve from reactive to proactive, Merrick Bank deployed Morphisec’s Anti-Ransomware Assurance Suite, powered Automated Moving Target Defense (AMTD), across endpoints, servers, VDI and cloud workloads. The results speak to the power of the preemptive mindset:

- 100% ransomware prevention with zero ransomware incidents since deployment.

- Blocked advanced attacks during internal red-team penetration testing.

- Legacy servers (including those processing card data and financial transactions) are protected without requiring heavy prerequisite upgrades.

- Improved audit and compliance outcomes: PCI-DSS audit findings closed, simplified compliance reporting.

- Operational efficiency gains: stabilization of performance (no I/O disruption), freed security team time, 1-2 hour average response via Technical Account Managers (TAMs).

By adopting a preemptive defense layer that complements their existing Microsoft environment, Merrick Bank not only plugged threat gaps but also strengthened its compliance posture and operational resilience.

What this means for your financial institution

If you’re responsible for cybersecurity, compliance or risk in a financial services environment, here are some implications:

- Review whether your current stack is built for pre-execution threat prevention, or just for detection and response.

- Map your legacy/foundation servers and workloads, which are often the weakest link, especially if they don’t support modern protection agents.

- Consider whether your security tools impose operational drag (slow servers, interrupt transactions), and evaluate alternatives aligned with the business need for uptime and performance.

- Ensure your compliance program isn’t just “audit-ready” on paper but reflects real-world controls that block today’s advanced threats.

- Communicate to leadership that the cost of a successful ransomware event in finance is not just remediation, but reputational loss, regulatory exposure, loss of customer trust, and business interruption.

The New Standard: Prevention as Proof of Compliance

In an era where nearly half of financial services firms getting hit by ransomware are seeing encryption of data, and where attackers increasingly exploit unknown gaps in defenses, the paradigm must shift.

Compliance alone no longer suffices. A proactive, preemptive cyber defense stance is now essential.

If you’d like to explore how Merrick Bank achieved significant defense, audit and compliance gains, download the full case study now and see how a preemptive mindset can transform your security posture.

Stay up-to-date

Get the latest resources, news, and threat research delivered to your inbox.